osceola county property tax payment

Tonia Hartline 301 W. Make an appointment online and save valuable time.

Registrations Taxsys Osceola County Tax Collector

This service allows you to search for a specific record within the Delinquent Tax database to make a payment on.

. Welcome to the Delinquent Tax Online Payment Service. Irlo Bronson Memorial Hwy. CLICK ON ANY OF THE FOLLOWING SELECTIONS TO MAKE A PAYMENT.

Osceola NOTICE TO TAX SALE. Taxpayers can call Personal Teller at 877-495-2729. Osceola County Courthouse 300 7th Street Sibley Iowa.

Welcome to the Tax Online Payment Service. Renew Vehicle Registration Search and Pay Property Tax Search and. Search and Pay Property Tax.

You can also make full or. In Osceola County Florida the median property tax for a home worth 199200 is 1887. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

Dont wait in line. Property Taxes Local Business Tax Receipt Driver License Vehicle Registration Renewal Mobile Home Registration. Property taxes in Miami-Dade County are among the highest in Florida with an average.

PAY TAXES RENEW YOUR TAGS AND MUCH MORE. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. If you are contemplating.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. If you are unable to pay your tax in full then you can make partial payments. Osceola Tax Collector Website.

Dont wait in line. Your account number is your parcel number that. Please contact the Collector office at 704 920-2119 to get your plan for payments.

Welcome to Osceola County Iowa. Tangible Personal Property Tax. You can talk to a live agent to pay with eCheck credit or debit card.

PAY TAXES RENEW YOUR TAGS AND MUCH MORE. The easiest way to file your tourist tax returns online. The Tax Collectors Office provides the following services.

Enjoy online payment options for your convenience. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Osceola County collects on average 095 of a propertys.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Search all services we offer. Search Use the search critera below to begin searching for.

Make an appointment online and save valuable time. Please correct the errors and try again.

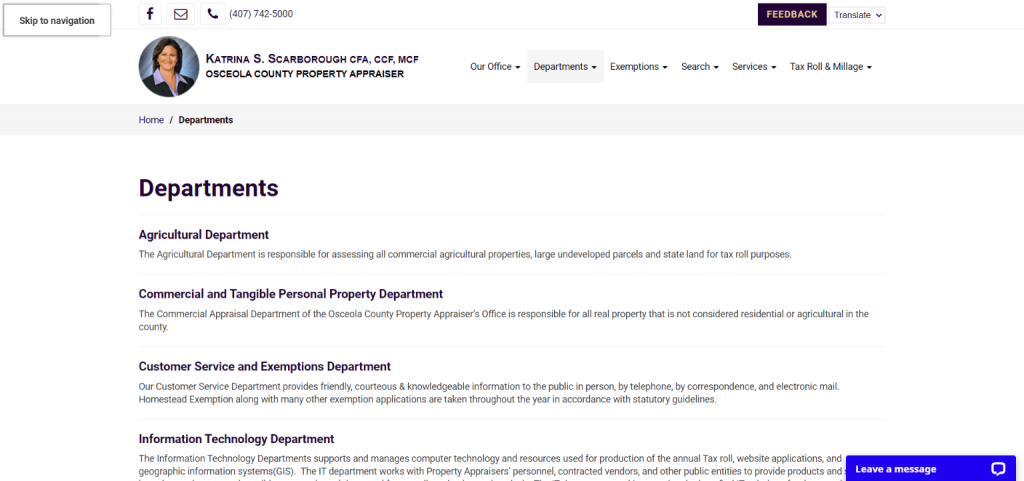

Property Appraiser S Office Offers New And Improved E File Homestead Application In English And Spanish Osceola News Gazette

Property Tax Installment Payment Due Soon If You Pay Your Property Taxes Using The Installment Plant The First Payment Is Due On Or Before June 30th Www Osceolataxcollector Org By Osceola County Tax

Osceola Clerk Of The Circuit Court Comptroller

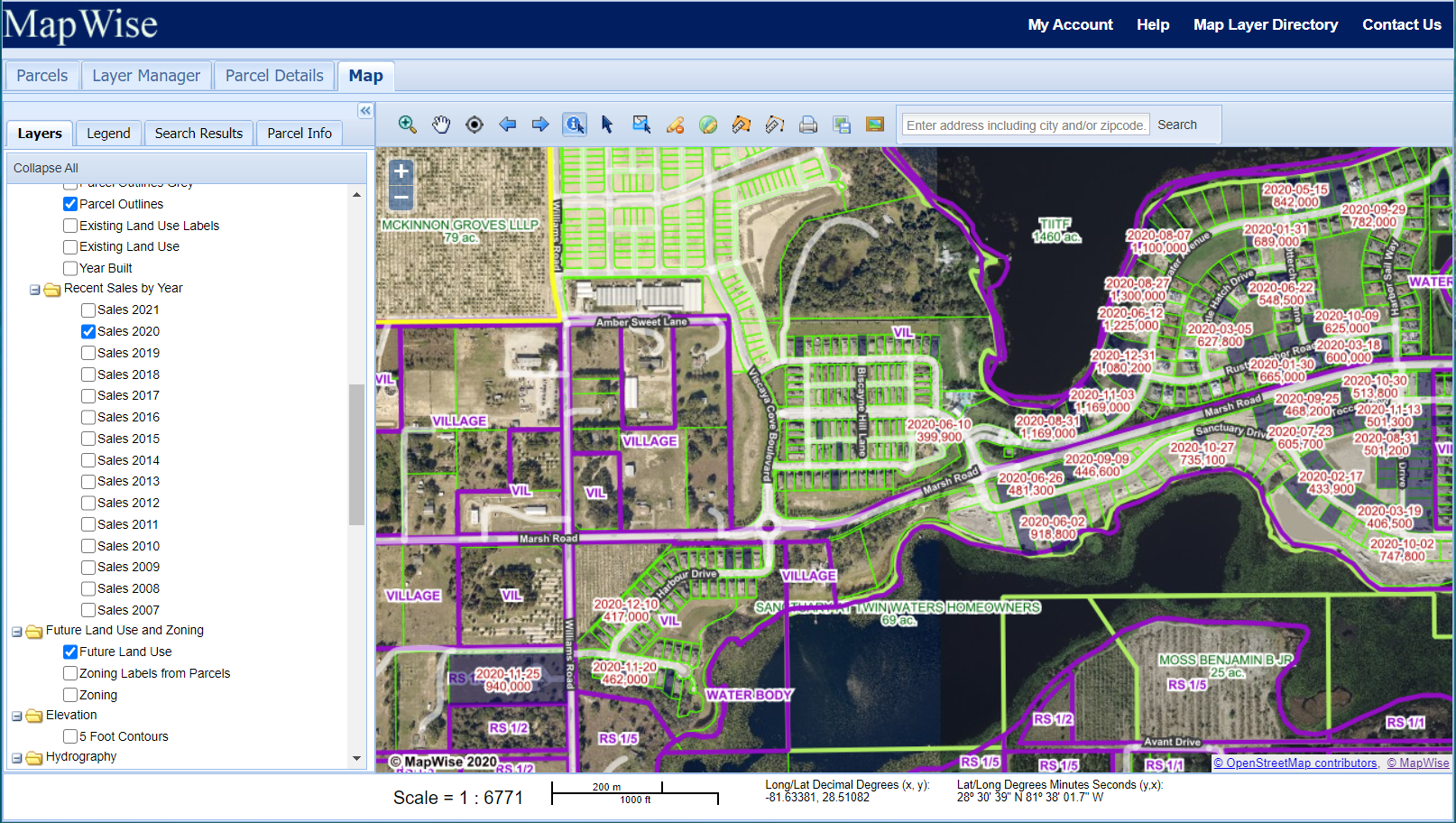

Florida County Property Appraiser Search Parcel Maps And Data

.png)

Designations And Certifications Osceola County Association Of Realtors The Trusted Source For Real Estate In Central Florida

Osceola County Property Appraiser Katrina S Scarborough Wins Re Election

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Tax Deed Sales General Information Osceola Clerk Of The Circuit Court Comptroller

Panelists Favor Osceola Property Tax Increase To Save Wetlands

Osceola County Property Appraiser On Linkedin Values Taxes Osceolacounty

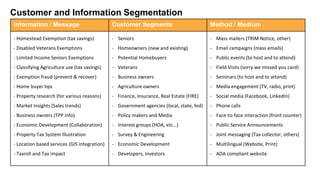

Osceola County Property Appraiser S Public Outreach Program

Sesquicentennial Celebrations Launch May 1 Osceola County Iowa

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Proposes Flat Property Tax Rate Orlando Sentinel